Fincen Boi Brochure

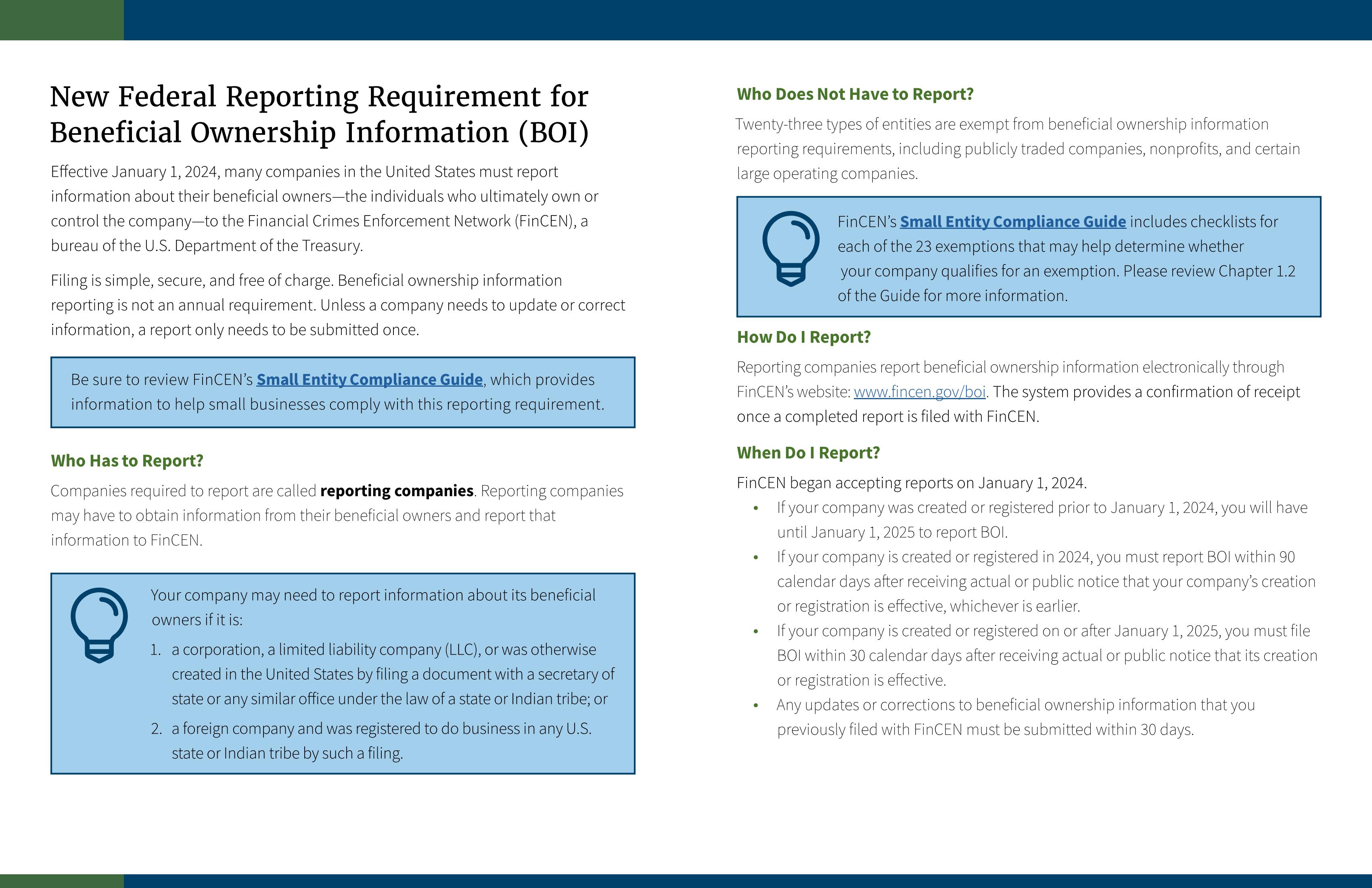

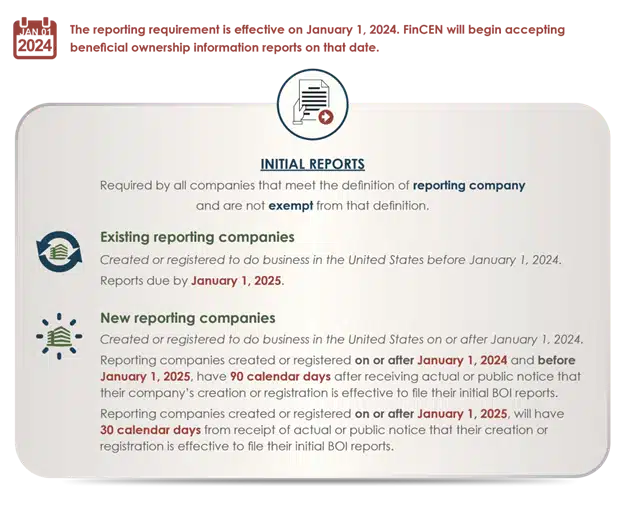

Fincen Boi Brochure - Beneficial owners are now exempt from the requirement to report beneficial ownership information (boi) to the financial crimes enforcement network (fincen) under the corporate. Fincen has invited comments on the rule and plans to issue a final rule later this year. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. Treasury department’s previous announcement, on march 21, 2025, the financial crimes enforcement network. You can easily report your company’s beneficial ownership information (boi) electronically through fincen’s website. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. As we previously discussed and in alignment with the u.s. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. This pamphlet is explanatory only and does not supplement or modify any. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. Fincen has published a new informational brochure, an introduction to beneficial ownership information reporting, and updated its beneficial ownership information. As we previously discussed and in alignment with the u.s. Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. Department of the treasury and the financial crimes enforcement network (fincen) have dramatically scaled back the scope of the. Alert [updated march 26, 2025]: All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. In a major regulatory shift, the u.s. Effective. The financial crimes enforcement network (fincen) of the u.s. Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. The preamble to the reporting rule also noted that while fincen's 2016 customer due diligence rule increased transparency by requiring covered financial institutions. Treasury. Treasury’s financial crimes enforcement network (fincen) issued a major revision to the corporate transparency act’s beneficial ownership information. Under the rule, domestic reporting companies are exempt from boi reporting. Alert [updated march 26, 2025]: Effective march 26, 2025, the u.s. Alert [updated march 26, 2025]: Beneficial owners must file boi reports with fincen. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the.. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. File your report resources to learn more Treasury’s financial crimes enforcement network (fincen) issued a major revision to the corporate transparency. Treasury’s financial crimes enforcement network (fincen) issued a major revision to the corporate transparency act’s beneficial ownership information. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. Reporting companies report beneficial ownership information electronically through fincen’s website: Department of the. Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. This pamphlet is explanatory only and does not supplement or modify any. Fincen has announced that beneficial. Beneficial owners are now exempt from the requirement to report beneficial ownership information (boi) to the financial crimes enforcement network (fincen) under the corporate. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. Treasury department’s previous announcement, on march 21, 2025, the financial crimes. Treasury’s financial crimes enforcement network (fincen) issued a major revision to the corporate transparency act’s beneficial ownership information. Alert [updated march 26, 2025]: The rule requires most corporations, limited liability companies (llcs), and other entities established in or registered to operate within the united states to report their beneficial owners. All entities created in the united states — including those. Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. In a major regulatory shift, the u.s. Go to fincen.gov/boi to determine if your new entity needs to report information about its beneficial owners—the real people who ultimately own or control the company—to.. Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. Under the rule, domestic reporting companies are exempt from boi reporting. You can easily report your company’s beneficial ownership information (boi) electronically through fincen’s website. The rule requires most corporations, limited liability companies (llcs), and other entities established in or registered to operate within the united states to report their beneficial owners. File your report resources to learn more Department of the treasury and the financial crimes enforcement network (fincen) have dramatically scaled back the scope of the. Beneficial owners are now exempt from the requirement to report beneficial ownership information (boi) to the financial crimes enforcement network (fincen) under the corporate. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. Beneficial owners must file boi reports with fincen. Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. Treasury department’s previous announcement, on march 21, 2025, the financial crimes enforcement network. The financial crimes enforcement network (fincen) of the u.s. Alert [updated march 26, 2025]: Fincen has published a new informational brochure, an introduction to beneficial ownership information reporting, and updated its beneficial ownership information.How to correctly file the BOI with FinCEN.

Do I Need To File The FINCEN BOI Report Every Year? FreedomTax

Beneficial Ownership Information Grandview Bank

FINCEN BOI Report (Step by Step Instructions Guide) FreedomTax

A Guide to FinCEN BOI, Beneficial Ownership Information 1800Accountant

FinCEN's BOI Form New Reporting Requirement For Small Businesses

FinCEN Publishes Initial Guidance and FAQs on BOI Reporting Under CTA

FINCEN BOI Reporting Tax1099 Blog

How To File The BOI Report With FINCEN Correctly Guide to Beneficial

FinCEN BOI Reporting Don't Miss Filing

This Pamphlet Is Explanatory Only And Does Not Supplement Or Modify Any.

In A Major Regulatory Shift, The U.s.

Certain Types Of Corporations, Limited Liability Companies, And Other Similar Entities Created In Or Registered To Do Business In The United States Must Report Information About Their Beneficial.

The Preamble To The Reporting Rule Also Noted That While Fincen's 2016 Customer Due Diligence Rule Increased Transparency By Requiring Covered Financial Institutions.

Related Post: